Key Walmart Metrics

Following similar news from Target, Old Navy, Kohl’s, and others, Walmart announced that sales of discretionary goods--especially apparel--were running materially below its plans, impacting margins and earnings in the process. The company expects its 2Q22 (July-end quarter) and full-year 2022 earnings to decrease around 13% as clearance actions are taken to clear inventory at both Walmart and Sam’s Club, as well as a negative sales mix. This lower view of margins would represent Walmart's lowest full-year margin in at least the past two decades and one below its pre-COVID margin.

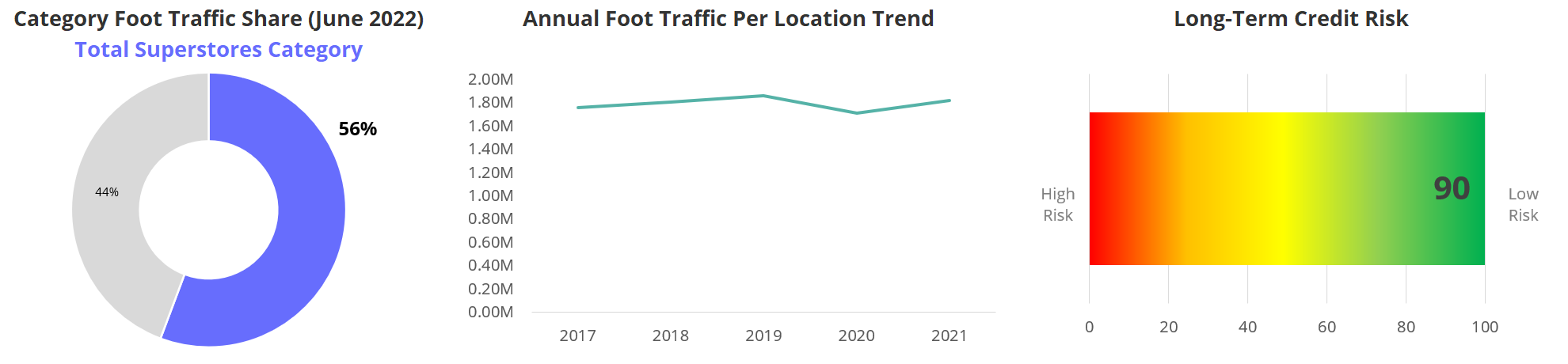

- Walmart's update announcement also noted that, "Food inflation is double-digits and higher than at the end of 1Q22. This is affecting customers’ ability to spend on general merchandise categories and requiring more markdowns to move through the inventory, particularly apparel." Walmart CEO Doug McMillion stated that, "We’re now anticipating more pressure on general merchandise in the back half [of the year]." While consumers increased visits to superstores as inflation rose during April and May, YoY visitation trends in June softened materially (below) and lend credence to McMillon's comments.

- Of note, Walmart said they are seeing signs of trade down, particularly in grocery. This includes an acceleration in private label penetration and more households shopping for groceries across income groups.

- The company expects comparable store sales for the quarter to be up +6% and is planning for +3% in 2H22. As grocery is 50% of its sales mix, that implies that nearly all of its general merchandise categories posted negative comparable sales in 2Q22 and are expected to do so in 2H22. For reference, 1Q22 grocery comps increased +12% and general merchandise decreased -3%.

- Of note, Walmart is primarily focused on markdowns--which should take longer although likely better for preserving margins--whereas Target and Kohl's are more focused on a liquidation strategy with targeting clean inventory by the end of 2Q22.

- Given Walmart's enormous size and the magnitude of its planned clearance activity combined with price reductions at Target, it will create downward pressure across all of mid-tier and below retail, as well as downward pressure on core CPI. We would also expect these retailers to push for price rollbacks from their suppliers, both for general merchandise and grocery items.

- Placer.ai shows visitation trends for Walmart and Target sliding lower in June, following the slide at Kroger and Albertsons. (See our 7/15/22 report for more discussion on the impact of food and gas inflation on the grocery category).

- With respect to visits on a year-over-three-year (Yo3Y) basis, Walmart’s traffic pulled lower in June and July as well, whereas Target and Albertsons have remained relatively stable. When Kroger reported results in mid-June, CEO Rodney McMullen shared that its "customers are coming in more frequently than before but they're not buying as many items on each shop." Since those comments, it's apparent that "more frequently" has inflected to "less frequently".

- How to think about the different brands and their health? First, we would observe that demand destruction is part of the Fed’s plan. Two, we are cycling unprecedented times. Three, we are coming off a very flourishing period of demand for goods and personal spending, a champagne moment period, filled with lots of levity. These are all macro and affect all brands, and we are in a settling period. (See our comments on Shopify.) And so, we think that as things "settle back" we want to see companies also settle back into their pre-pandemic trend, if not better. That is what Target is demonstrating. For those that were doing well, and that can track, if not improve upon, their pre-pandemic trend, things will begin to normalize and their sales and earnings will grow again. For those that weren’t or can’t, we’d be wary.