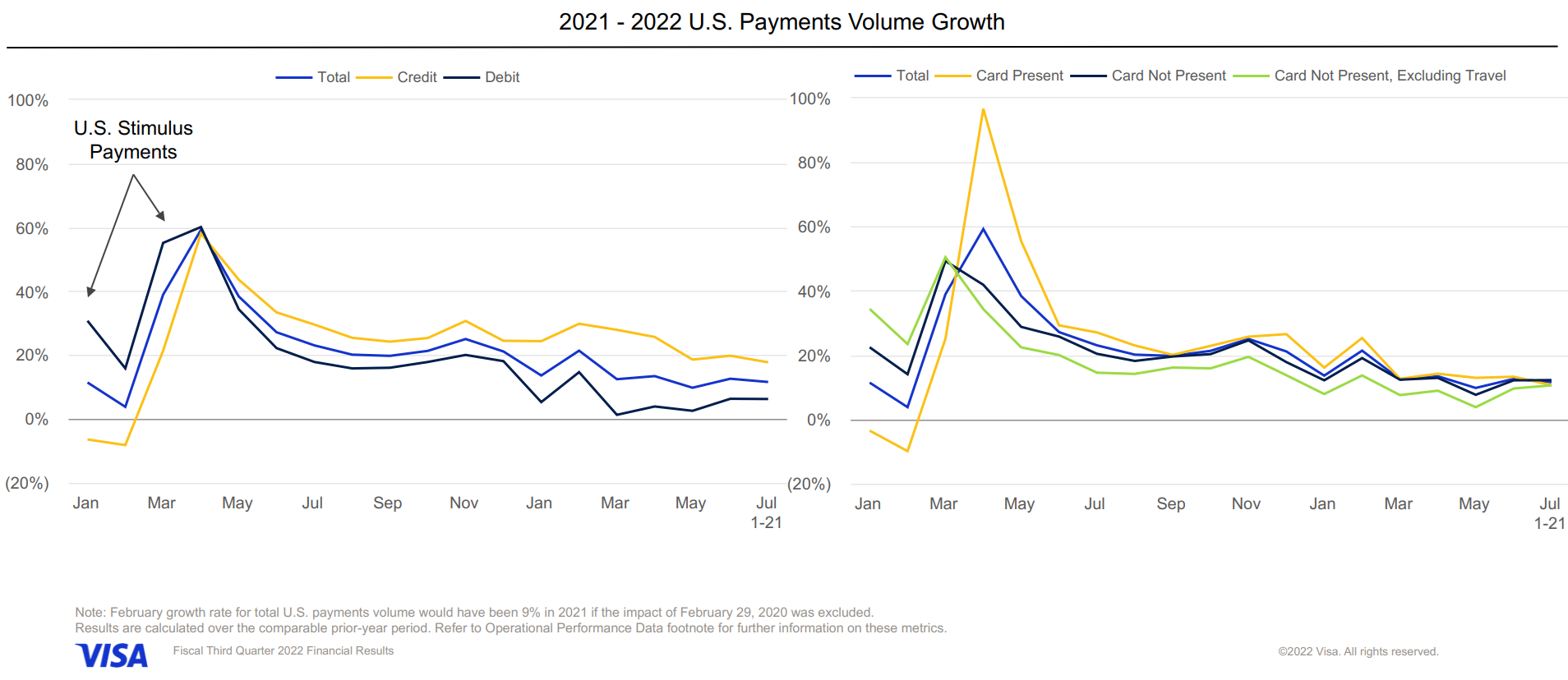

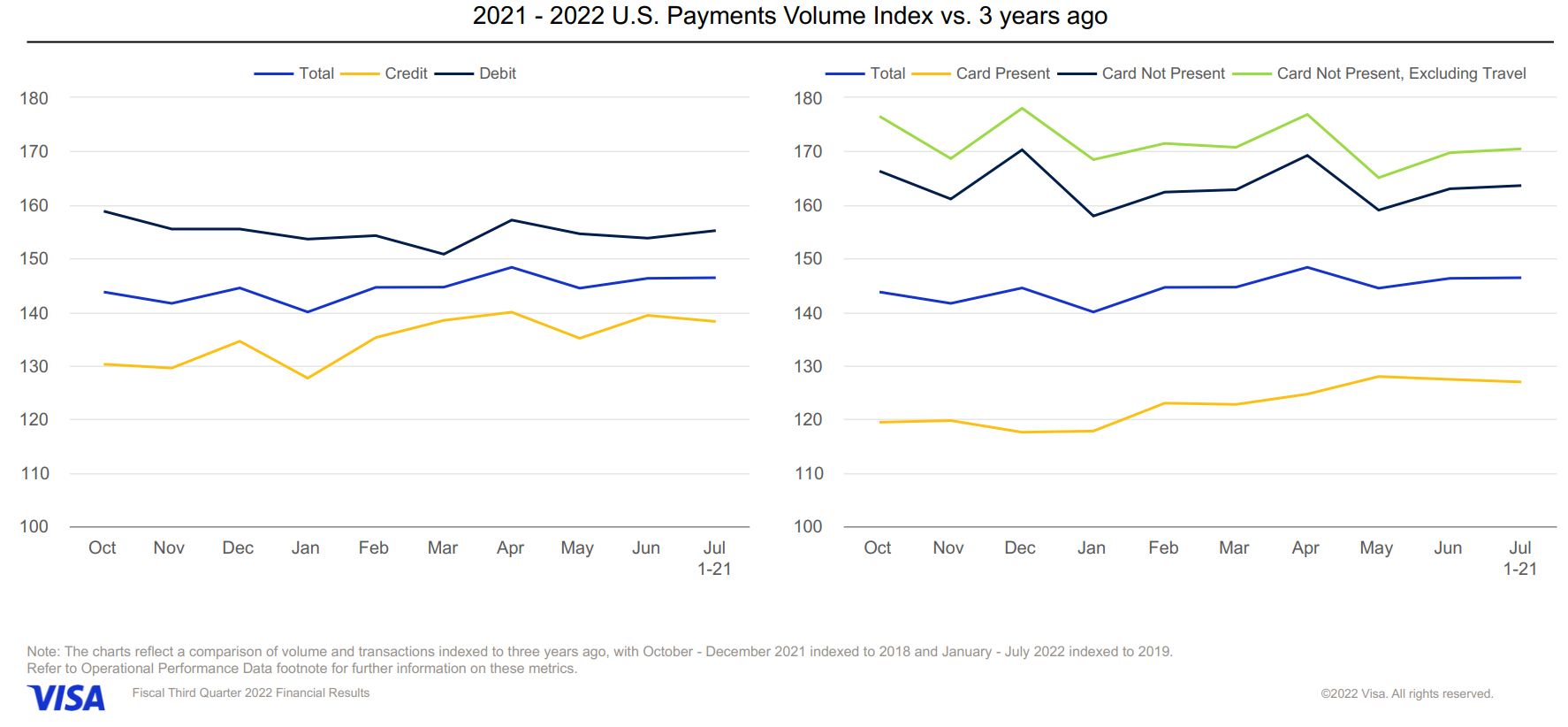

- Visa CEO Al Kelly: "[We're seeing no evidence of a pullback in consumer spending]...this has been the case for most of 2022 with no indication of any slowdown, including in more recent weeks...Early in the pandemic, goods surpassed services, reversing the historic trend. Even as services have rebounded in the last 6 months, the percentage spending on goods in our payments volume still remains higher than the pre-pandemic levels. For example, while U.S. home improvement and retail goods spending during the third quarter grew only low single digits year-over-year, it remains well ahead of the pre-pandemic trend line. Second, many discretionary segments have further strengthened. If you look at U.S. travel spend, it is now back – it is not back to the pre-COVID trend line but grew more than 40% versus last year. Third, the affluent spender continued to recover, particularly in the areas of restaurants, travel and entertainment. At the same time, nonaffluent spend remained relatively resilient. We mentioned the affluent spend returning to restaurants last quarter. That trend continued this quarter with affluent restaurant spend indexing in the 160%-180% range versus 2019... [In regard to inflation and a spending pull back], U.S. transaction growth relative to 2019 is strong and stable."

- On cross-border travel, CFO Vasant Prabhu shared, "There's a huge amount of interest in traveling to Europe...so Europe has been also recovering very fast and is indexing at pretty high levels relative to pre-COVID volumes. The other area that continues to surprise is Latin America...Outbound from the U.S. is very strong. It's been at about 2019 levels now for a few, if not weeks, a couple of months. Inbound to the U.S. we told you was indexing in the high 80s, so it's still below 2019 levels. We think that there's room for recovery there. What we've seen on the cross-border side is a little bit of a stair step where you have periods where there's rapid growth...When a variety of countries remove restrictions, you see a huge amount of travel happening fairly quickly. And then you see a certain amount of stabilization after that...As we look at the fourth quarter, most of the world is open. We are assuming steady improvement in travel out of Asia, steady improvement of travel into and out of Europe, improvement of travel into the U.S."

- Regarding consumer spending:

Visa CEO Al Kelly

"Affluent spenders are returning to the economy and their higher spending in restaurants and travel, among other categories. And this isn't necessarily inflation, but a mix shift. The impact of people working from home and hybrid work definitely continue to have impact on smaller tickets that are things that people buy in the mornings and at lunch time when they're actually commuting and working in an office environment. Certainly, small tickets, as a percentage of overall tickets, are still below pre-pandemic levels as a result. Last year, stimulus clearly drove ticket sizes up, particularly in discretionary categories, and we're kind of lapping that now. What we don't know are what level of substitutions are taking place, where people might be buying more staples and less discretionary items but they're spending at the same level they did, or whether as some retailers have said, people are trading down from brands to private labels. But it's also difficult for us to understand consumption reduction. For example, consumers could be buying less fuel, but spending at the same amount or buying smaller package sizes of things like snacks and yet spending the same amount...Clearly, inflation is in our numbers. And people are likely to change making some changes on what they're buying. But as I said earlier...they're not changing how they're paying."

CFO Vasant Prabhu

"We keep looking for [a slowdown in spending by lower income consumers] because we've heard some other people say it, and we're not seeing any evidence of that. We're also not seeing [signs of slower spending because of a wealth effect on affluent consumers due what's happening in the stock market]...If anything, affluent spending has been on the rise and is one of the reasons why we've seen some of the robust growth we saw this quarter. Remember, we're lapping a very significant growth quarter last year that included sizable stimulus payments. And despite that, we had some very good growth this quarter. And a lot of that is driven by affluent consumers, by discretionary spending coming back and no evidence of a wealth effect that people are holding back."