- T-Mobile expanded its fixed wireless access (FWA) broadband service into 32 U.S. cities and towns across California, many of which it stated were underserved communities, covering nearly half of all households across the state. The service is now available to more than six million homes in California and in excess of 40 million nationwide. (For a reminder why this important to CRE, please see our April 29 report.) T-Mobile reports 2Q22 results next week and so we will learn more about their momentum in FWA at that time. However, expectations are for over +500K FWA new subscriber additions. (For context, Verizon reported +265K FWA additions for 2Q22).

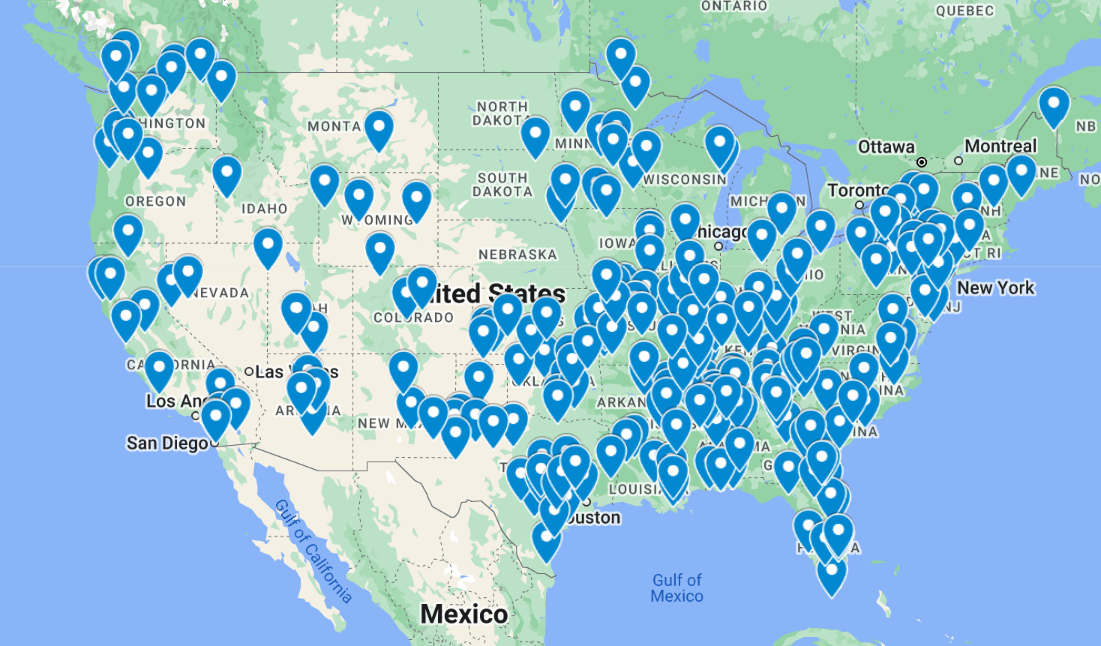

- Using Placer.ai, we examined where T-Mobile has established new locations in the U.S. since December 2021. Since then, there are an astonishing 405 new locations, including 147 shop-in-shops inside Costco (258 net of Costco). Looking over the 258 new locations (below), most are in smaller markets and suburban locations, as expected. This compares to approximately 26 new Verizon-branded stores. In contrast, AT&T opened a robust 114 new locations with concentrations in Arizona, California, Florida, New Jersey, Texas, and Washington.

- We've previously written about T-Mobile’s intentions to take meaningful share from Verizon and AT&T in their strongholds – namely, suburban and rural markets –where the two effectively had little competition. That muted competition incented the two to not invest in robust network coverage and capacity, thus fostering the rural-urban digital divide. With T-Mobile's new spectrum (acquired with Sprint) and the transition to 5G, T-Mobile would be able to correct this inequity (part of the reason that the FCC and DOJ agreed to the merger).

- Reaching those suburban and rural households required T-Mobile to establish a retail presence in these markets and that is demonstrated in those 256 new locations. How is it going? Verizon lost -215K postpaid and -229K prepaid phone customers during 2Q22. On its update call, Verizon management cited lower traffic into its stores and lower gross adds. We will see next week in T-Mobile’s results if that traffic showed up in its stores.