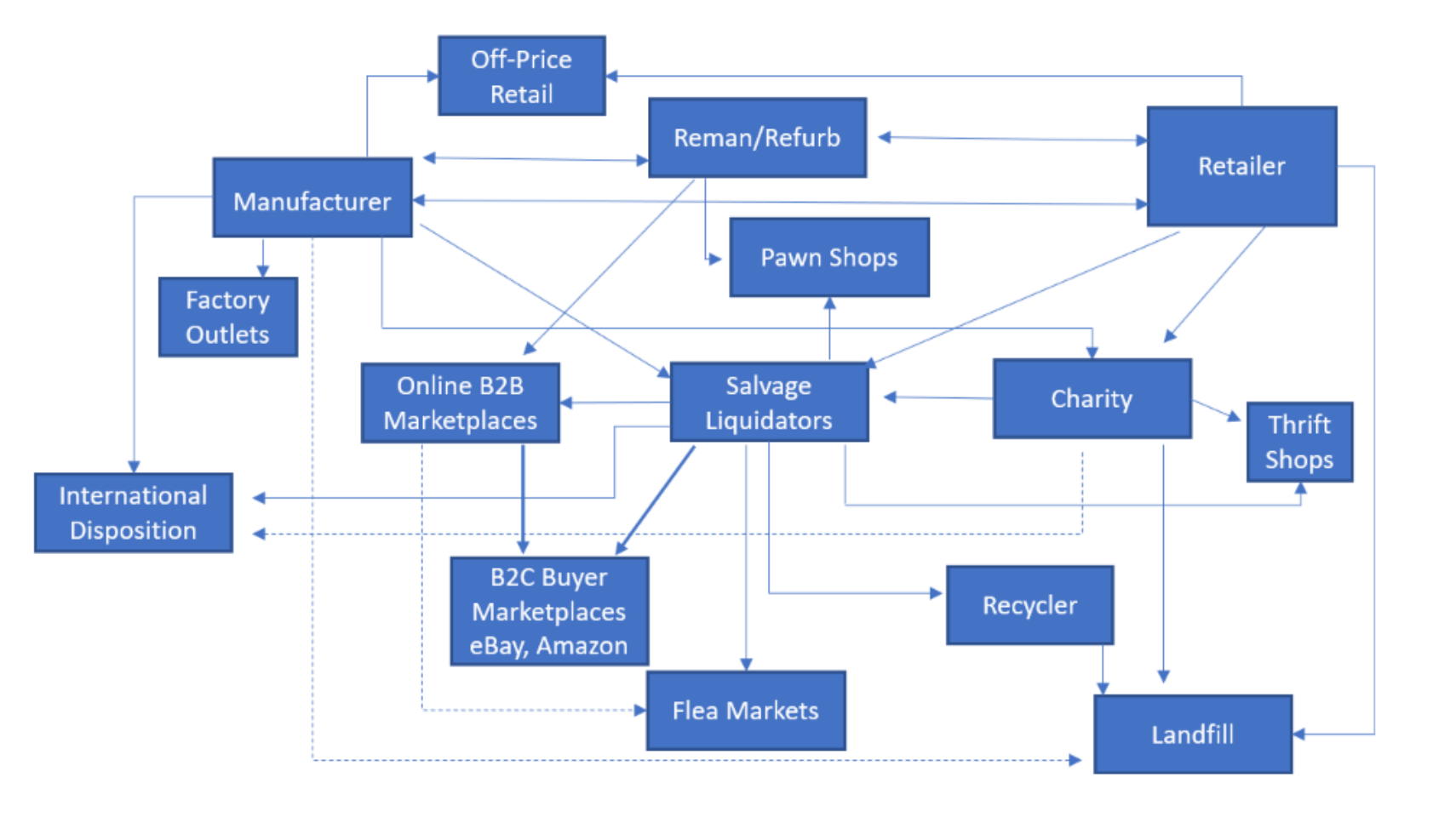

The Wall Street Journal wrote an interesting article about the rising level of excess goods at retailers due to supply chain delays/backlogs, double-ordering safety stock, and shifting consumer trends, which is becoming a boon for the liquidators. The article reads, “In many cases, the liquidators are picking up pallets at the ports or from a warehouse without the goods ever hitting store shelves and are selling the items to smaller retailers and individuals who resell them online.” We show how this industry works below.

Placer.ai data shows robust visitation trends at Bargain Hunt and Ollie’s Bargain Outlet. The glut is most acute in kitchen appliances, televisions, outdoor furniture, and apparel. For these brands, the availability situation was the direct opposite last year at this time, leaving few bargains at the stores and giving consumers little reason to visit the stores. This makes for very easy comparisons this year.

Ollie's CEO John Swygert recently discussed the industry supply chain situation with investors:

John Swygert, Ollie's Bargain Outlet CEO

"I will tell you now is almost a perfect storm. We started to talk about last year with the disruption in the supply chain, the later, I mean, orders that were coming in, there was going to be something that was going to break and that has happened. I think the demand has waned. I think the timing of the receipts were not all on time. So there's a lot of canceled orders out there. One thing that some people get confused with is we very rarely source from the retailer. Most of the product we get are from canceled orders that the retailer has canceled on the manufacturer or the vendor that is going to become available in the marketplace…So there are a lot of discretionary categories that are out there, and we are starting to see them in pretty heavy force at this point in time, some pretty incredible deals that we're seeing….We have to be super selective because these deals and the deal flow is going to by far outpace our ability to buy it all, but we are going to buy the best."

In contrast, last year the large off-price brands were able to secure cozy/comfy apparel and soft home goods and their 2Q21 comparable store sales grew an insane +15%-+36% relative to 2019, making for impossible comparisons (which partially explains the declines shown above). Additionally, large appliances, TVs, and outdoor furniture are not categories carried by Marshalls and Ross. As such, they are not attracting visits and “wowing” consumers with deep bargains in these categories. Thus, the soft traffic so far in 2Q22 for the off-price brands. The comparisons do not ease until August, so it shouldn't be surprising to see soft quarterly results for the category when results are reported in late August.