Key McDonald's Metrics

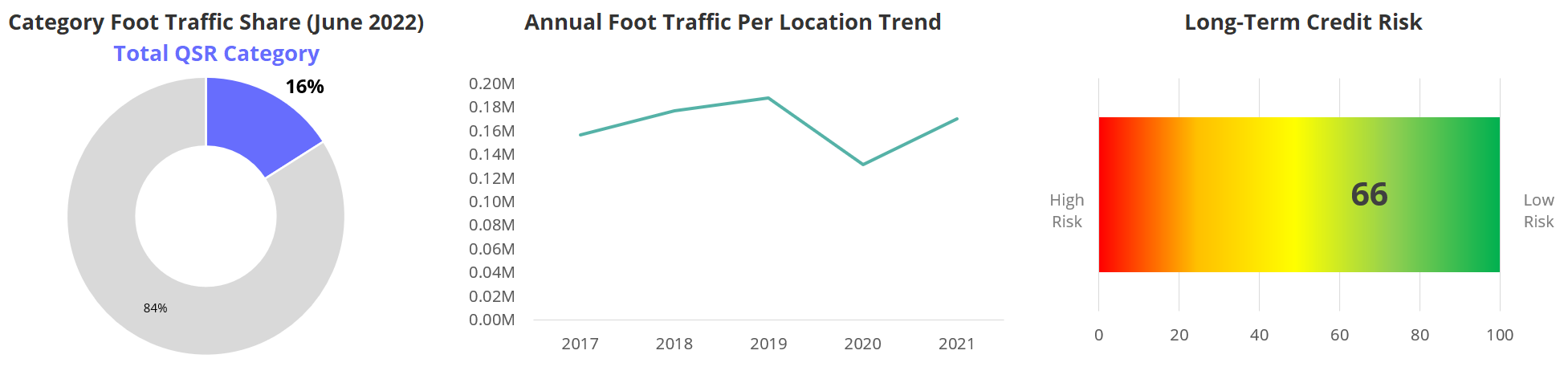

With foot traffic trending downward across much of the retail and restaurant industry, it’s easy to attribute McDonald’s resilient 2Q22 results to macro and industry factors. While the company has likely benefited from lower-to middle-income consumers’ shift away from fast casual and full service restaurants – see category visitation trends below – it’s also clear that other factors including digital marketing/exclusives and continued recovery at breakfast were also contributors. Not surprisingly, there was little discussion about U.S. franchisee concerns over changes to the company’s 20-year lease renewal process and other factors but McDonald’s recent visitation outperformance reinforces the overall health of its U.S. franchisees.

- Everyday affordability driving visitation outperformance. For 2Q22, McDonald’s posted U.S. comps of 4% driven by average check due to strategic price increases with overall transaction counts coming in flat. Placer.ai’s data suggests that in-store visits were positive year-over-year (YoY, below), but that short-visits (drive-thru and mobile-order takeout) started to decline on a year-over-year basis starting in June. Like past cyclical downturns, it appears that McDonald’s everyday affordability will continue to benefit visits in the near future (management noted that its customers have been "resilient" with only some trade-down among lower-income consumers). Historically, McDonald’s comparable restaurant sales trends have been less impacted by gas prices – a byproduct of 75% of the population across the company’s top markets living within three miles of a McDonald’s location – and are more correlated with unemployment rates and wage growth, both of which have remained positive.

- Breakfast daypart recovery? During the quarter, McDonald’s posted positive comps across all dayparts in the U.S., led by breakfast. Our data confirms positive in-store visitation trends across all dayparts during 2Q22 (below), with breakfast and dinner seeing the strongest growth. Breakfast has historically been an outsized contributor to McDonald’s sales trends – nearly 30% of the U.S. revenue mix – so it’s encouraging to see the growth in this daypart as consumers gradually return to work.

- Expanded McPlant test ended. In other interesting developments from the quarter, McDonald’s has ended the test of its McPlant burger in the U.S., which had been expanded to 600 stores in Dallas and San Francisco earlier in 2022. Earlier this month, we reviewed visitation trends from McDonald’s stores in these markets and saw that, at least in Dallas, McDonald’s growth trends had been outperforming the broader QSR market by a wide margin. However, after seeing reports that McPlant sales were disappointing and that the product was pulled from stores in many markets, it appears as if the outperformance in Dallas was due to other factors cited above. While McDonald’s may revisit McPlant in the future, it may take a different approach to the test (i.e., urban versus suburban locations).