This past week, Hurricane Ian disrupted the lives of many across Southwest Florida and brought unprecedented property damage. As of Friday, the storm had regained strength and was set to bring heavy rain and damaging winds to South Carolina. It will undoubtedly be some time before these regions recover from this disaster–and our thoughts and prayers go out to those impacted by the hurricane–but we thought we’d put some context behind the visitation trends for some of the retailers most associated with the storm preparedness efforts and the chains that could be most impacted during the recovery process.

- Home improvement. In the past, home improvement retailers have seen a material lift in visits ahead of major storms as consumer stock up on generators, plywood, and other emergency preparedness products (which inflate sales results for these retailers–both in terms of traffic and ticket–but tends to dilute profitability because these are lower margin products). We reviewed visitation data for Home Depot and Lowe’s across the Tampa market (Home Depot has 34 stores in the market and Lowe’s has 35), and found that visits to both chains on Saturday, Sep. 24 exceeded its average year-to-date Saturday visits by roughly 20%. Monday, Sep. 26 set a new high for the year, with visits exceeding year-to-date Saturday visits by 40%-45%.

Both Home Depot and Lowe’s have extensive experience with Hurricane recovery efforts, including coordination between operations, supply chain, and merchandising chains to reallocate inventory outside hurricane strike zones and stocking extra emergency products (Home Depot has published details on how it manages its hurricane preparedness efforts, which can be found here). Visit trends will likely remain elevated compared to year-to-date trends for the next several weeks as recovery efforts accelerate.

- Grocery and superstores. Like the home improvement retailers, we saw a similar uptick in visits at grocery and superstores ahead of Hurricane Ian, with both categories seeing visits that approached their year-to-date highs. On Saturday, Sep. 24, grocery stores in the Tampa area saw visits that were almost 30% of their year-to-date Saturday average, while superstores saw a 23% lift. On Monday, Sep. 26, grocery stores saw visits that were 35% ahead of their year-to-date Saturday average, while superstore visits were essentially flat with year-to-date Saturday averages (which might be due to store closures ahead of the storm).

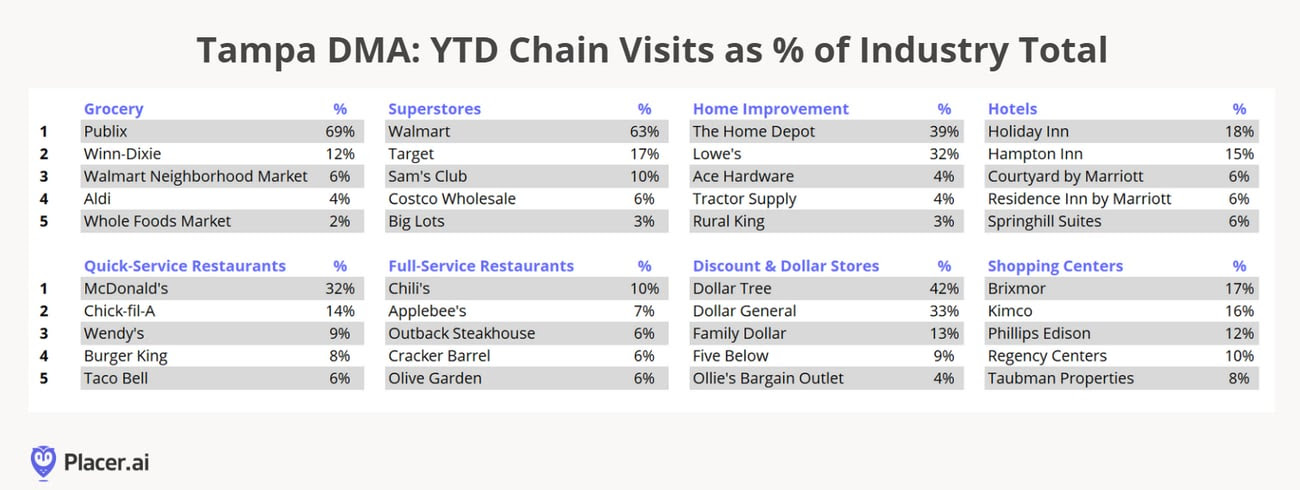

- Which retail chains have the greatest exposure to the storm? With the unprecedented scale of damage caused by Hurricane Ian, it will also result in store closures and reduced visitation trends over the next several weeks. Below, we’ve presented which chains have the greatest exposure to the Tampa/St. Petersburg/Sarasota area for the grocery, superstore, home improvement, hotel, quick-service restaurant, full-service restaurant, discount/dollar store, and shopping center industries.