- Google’s 2Q22 advertising results reflected the slowdown in the digital economy, lapping two years of juice in the digital economic, share losses to TikTok, and geopolitical/macro headwinds.

- Chief Business Officer Philipp Schindler shared, "From a trend perspective...omnichannel remains the way to when retailers continue to build their digital presence to drive both online and offline sales, and we're obviously helping them do it...For example, local inventory ads. These are mobile-first and location-based and helping businesses of all sizes showcase their products and stock in-store, online or available for store, curbside pickup, all different variations. Additionally, we're midway through the migration from smart shopping campaigns...and advertisers have been pleased with increased reach and the increased performance. Our focus really has always been on building tools and features that help both offline and online businesses connect directly with these customers across our platforms, and we're excited about what's next for retail commerce across our services, especially search and YouTube." (See our comments from our 6/17/22 report on how physical is being viewed as the driver for digital.)

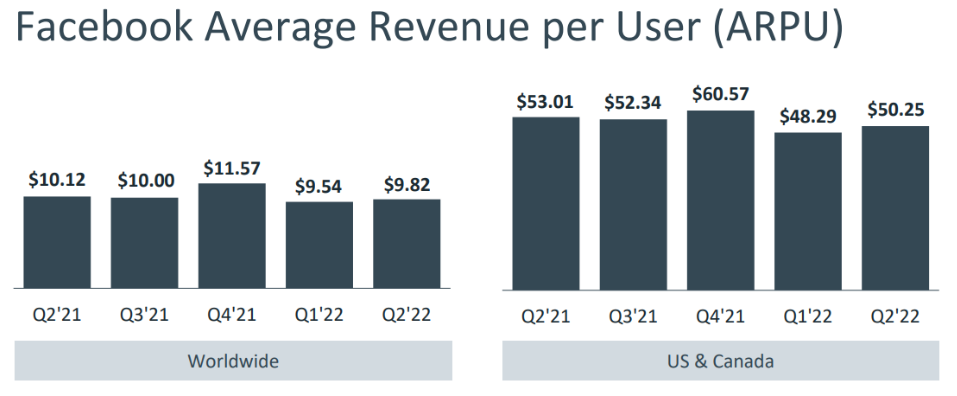

- Meta reported a decline in advertising revenue per U.S. user (ARPU) and guided for flattish YoY revenue growth in 3Q22, which at $27.3B is $3.5B below recently lowered Wall Street expectations. Analysts now expect to 4Q22 revenue growth to be flattish as well. Meta’s advertising in the U.S. has been principally driven by slicing the audience into niche-like targeted segments and then charging a lot for that. "Slicing" is now going the other way due to IDFA and demand is dropping, which drives down pricing. As a reminder, on a trailing-twelve-month basis, Meta generates $211 in ad revenue per user in the U.S., which is a really big number.

- Meta CEO Mark Zuckerberg said, "We seem to have entered an economic downturn that will have a broad impact on the digital advertising business. And it's always hard to predict how deep or how long these cycles will be, but I'd say that the situation seems worse than it did a quarter ago...Given the more recent revenue trajectory that we're seeing, we are slowing the pace of…investments and pushing some expenses that would have come in the next year or two, off to a somewhat longer timeline. Our plan is to steadily reduce headcount growth over the next year."

- In response to its ad targeting challenges stemming from IDFA, Meta is adapting its ad system to manage with less outside data by growing on-side data conversations. Said differently, the company wants to drive engagement and time spent higher (reversing an earlier strategy), Reels (see TikTok), and "click-to-message" ads.

- Meta CFO Dave Wehner said, "We're also continuing to face targeting and measurement headwinds such as Apple's iOS changes, which we believe are contributing to the growth challenges across the digital advertising industry." "Headwinds" implies that the challenge was strengthened, not slackened as they lap those headwinds that were present in 2020 and 2021. Wehner noted that, "We're seeing just generally challenging environment for digital advertising…[as] we're lapping periods in which there was still a benefit from COVID in some of the sectors that are important to us, like e-commerce."

- Meta COO Sheryl Sandberg, "We know we have to earn our share and continue to deliver great ROI and be able to measure results. (Declining measurement and ROI is what’s behind Meta’s declining advertiser participation and revenue.) And on Reels, "There are still some challenges. Video is harder than photos, than static photos. Small businesses are better at static photos than they are at video…[Reels] is very promising but we've got some hard work ahead of us."