- Universal’s Minions: The Rise of Gru opened far above expectations with an opening weekend of $107M in the U.S. which benefited from the timing of July 4. Additionally, it doubled Lightyear’s opening of $50M and has topped Lightyear’s total which is decaying quickly WoW. Minions’ success is a much-needed proof point that kids' movies can perform in a post-COVID cinematographic universe (or that we're all just living in one big TikTok).

- This weekend’s tentpole opening is Thor: Love & Thunder where expectations are for a whopping and minion-thumping $150M.

- Tom Cruise’s Top Gun continues to be a maverick in sustainability with a very moderate WoW decay in weekend box office. The film has now done nearly $600M and $1.2B in domestic and global box office receipts, respectively.

- Looking out, 3Q22 releases are lighter than 2Q22. For outsized box office drivers beyond Thor, there is Bullet Train and Nope. 4Q22 is where the action is with Strange World, Shazam!, Black Adam, Black Panther 2, and Avatar 2. 1Q23 is shaping up to be another strong quarter with Kraven the Hunter, Aquaman 2, Creed 3, John Wick: Chapter 3, and Ant-Man 3. 2Q23 is as well, including Guardians of the Galaxy 3. As such, following a pause in 3Q22, the box office slate is packed with big releases for the following nine months.

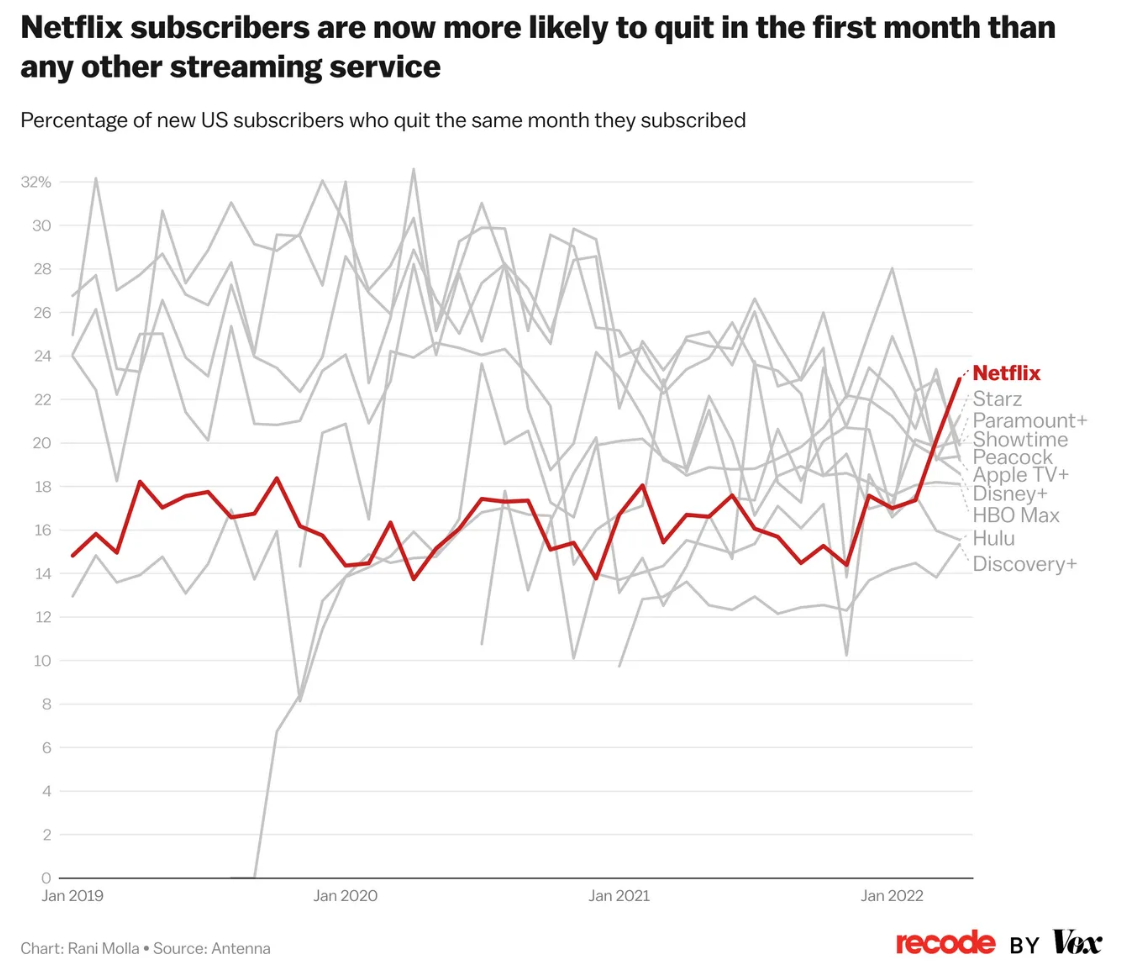

- As it relates to the future of the box office and the health of the exhibitors (Regal, Cinemark, AMC, etc.) the VOX had an interesting article about Netflix, including the exhibit below showing that by the end of April, 23% of new sign-ups dropped the service within one month. Said differently, roughly a quarter of sign-ups are there for the drop of a new series and then they churn. However, as shown, that is also true of most of the other services at a fifth. We suspect that this phenomenon is likely to nudge the studios more solidly towards the six-week exhibitor exclusive window and away from streaming (HBO Max, Paramount+, and Disney+) as they see that they don’t win long-term loyalty with a large segment of streamers plus the other benefits that a film receives for the six-week exclusive.

- Also of note, Netflix is expected to see its subscribers decline by 2M-3M for its June quarter. That decline, in combination with its cost-cutting initiatives with a sharper focus on what it is willing to pay for a film, makes exhibitor distribution more attractive relative to selling the release to Netflix than previously. This of course is a shift in the scale of the movie industry towards the exhibitors and away from streaming.