Key Best Buy Metrics

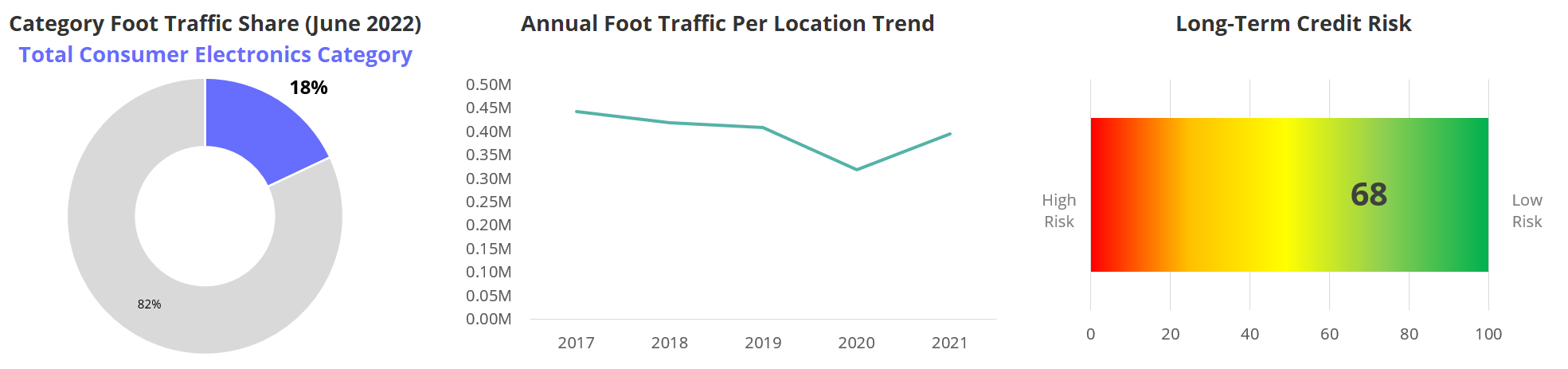

With the consumer electronics retail category already underperforming the broader retail industry as it lapped last year’s government stimulus efforts, it’s not surprising that Best Buy revised its calendar 2Q22 outlook downward as visitation trends continued to soften since the company reported its calendar 1Q22 results in May.

- Visitation trends. Best Buy management expects calendar 2Q22/fiscal 2Q23 (quarter ending in July 2022) comparable sales to decline approximately 13%, versus a 19.6% comparable sales growth in 2Q21. Placer.ai data (below) suggests that Best Buy’s YoY visitation trends have been declining in the mid-to high-teens for much of the quarter. When coupled with inflation, slowing home furnishing product sales (which we believe has impacted Best Buy’s appliance sales), supply chain constraints, and the absence of a major consumer electronics product cycle, this outlook makes sense. The company expects its 2Q22 adjusted operating income rate to be in a range around 3.7%, versus 6.9% a year ago. Additionally, Best Buy anticipates quarter-end inventory balances to be approximately flat to the same period last year.

- Back half outlook. For the full-year, Best Buy is forecasting a comparable store sales decline of approximately 11% (compared to a previous outlook calling for a 3%-6% decline), which factors in "ongoing uncertainty as it relates to macroeconomic conditions and consumer electronics demand" as well as "increased promotional activity in the consumer electronics industry".

- Alternative formats continue to offer promise. While it’s likely that we’ll continue to see YoY visitation declines, we remain encouraged by Best Buy’s evolving store layout formats, which do a better job of addressing various need states for different consumer electronics shoppers. We’ve previously discussed Best Buy’s outlet and experiential formats, but the company also unveiled a small-format, ‘digital-first’ store in Monroe, NC this week.