Bank of America

- Bank of America CEO Brian Moynihan: " Consumers continue to spend at a healthy pace even as quite some time has passed since the receipt of any stimulus. Second, the overall average deposit balances for most cohorts are higher than they were last quarter and even rose in June versus May. They remain at multiples above the pre-pandemic levels. And importantly, we're seeing no deterioration in our customers' asset quality, and they have the capability to borrow."

- "In June 2022, spending was up 11.3% over June 2021. Transactions also rose more than 6%. For the first two weeks of July, the spending is up 10% plus in transactions, again, rising 6% plus. This is strong consumer resilience. We continue to see shifts in what people are spending on as the quarter took place more on experiences, travel and things like that and a bit more on fuel due to increased prices and less on retail stores. "

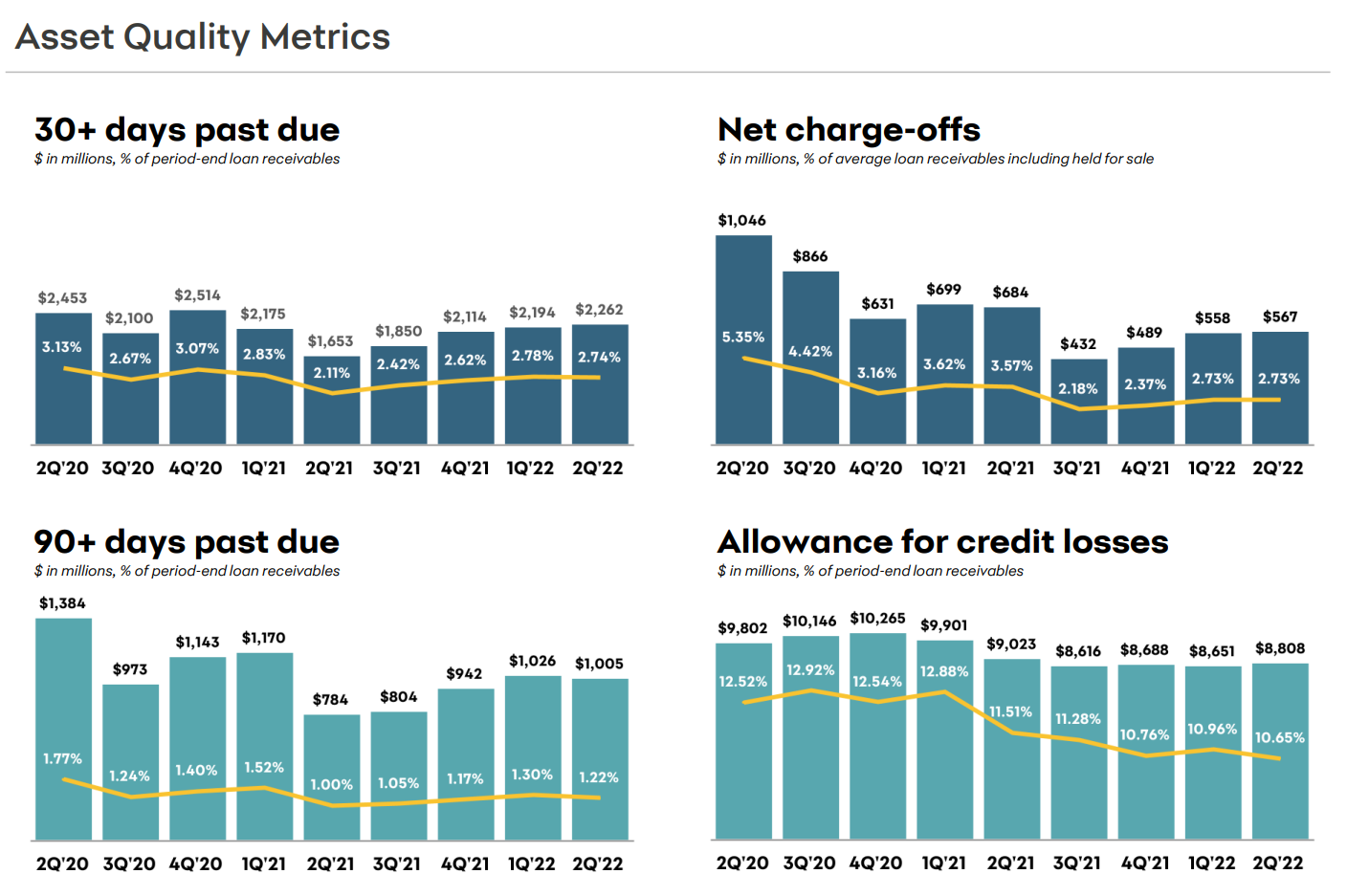

- As shown in below, Bank of America’s credit card portfolio is stable from a delinquency perspective.

Synchrony Financial

- Synchrony Financial CFO Brian Wenzel: "During the second quarter, consumers rotated their spend within discretionary and nondiscretionary categories as they manage higher costs from inflationary pressures while still fulfilling their everyday purchases…These fluctuations likely indicate that the consumer is not actively reducing total spend or frequency, but rather rotating their overall spend. For example, in certain categories like grocery, it appears that our customer is managing to ticket size and substituting items that are a greater priority, whether that means choosing a generic brand or forgoing a less desired item. In terms of gas station spend, however, average transaction values have accelerated with rising gas prices, but transaction frequency has generally held constant, if not increased slightly. All this is to say we continue to see trends of a strong consumer who is moving through their day-to-day and spending money without meaningfully changing their choices or priorities."

- "I think the strongest credit we see is actually in the prime, so not super prime and not nonprime, but we are seeing continued strength in the nonprime. There's nothing discernible as I look across the credit grade either on a transaction value basis or a frequency basis, nor do we see it across any of the sales platforms. It's remarkably consistent the performance and the growth across all the platforms by credit grade...I look at the data by category, what we're seeing is that the consumer is not changing spending dollar-wise and their behaviors. They're just making different decisions inside their everyday spend. And it's not even just moving from discretionary, non-discretionary. They're just being more discriminate with regard to how they're spending their money."

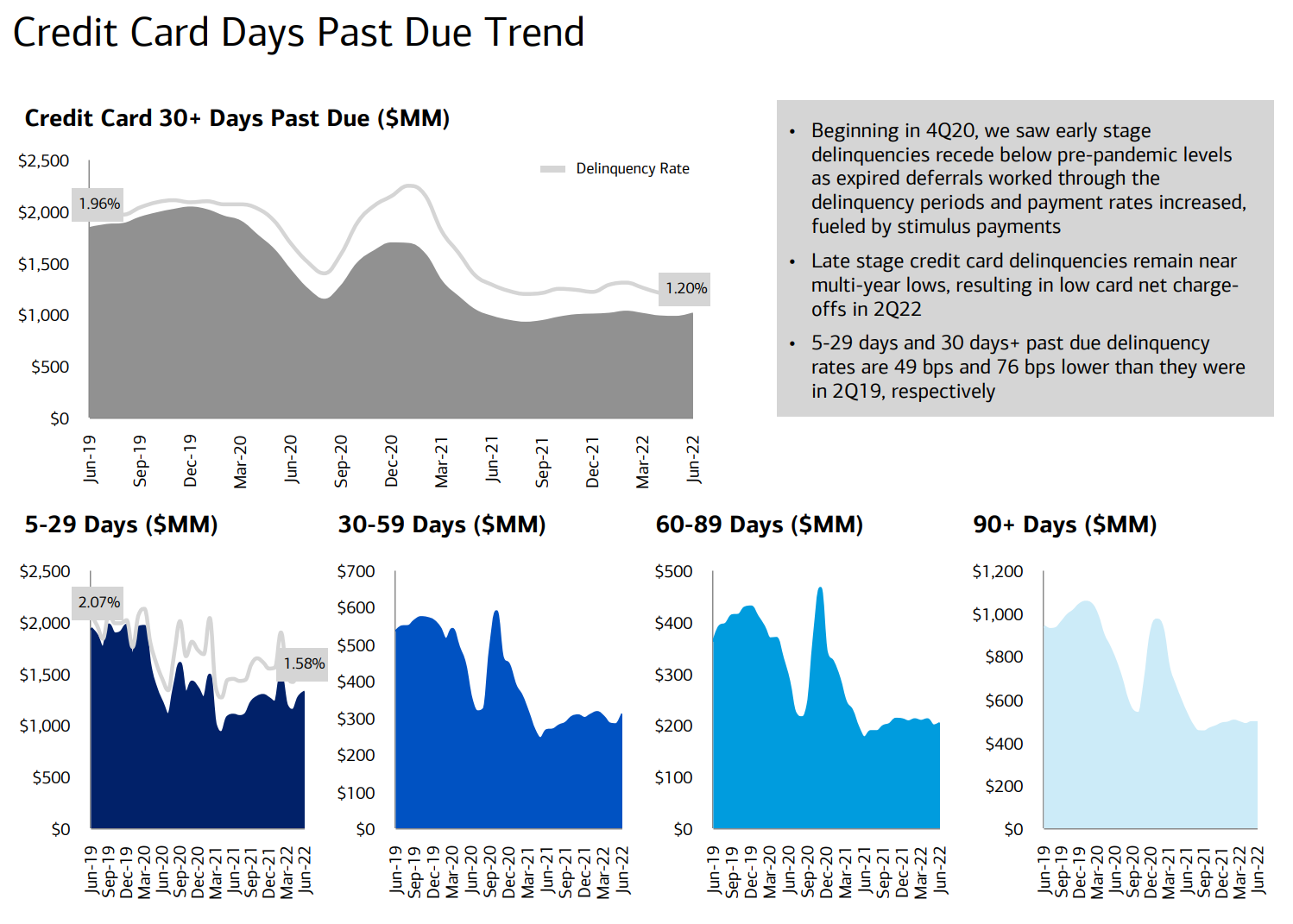

- Synchrony's credit card portfolio is also stable from a delinquency perspective (below).