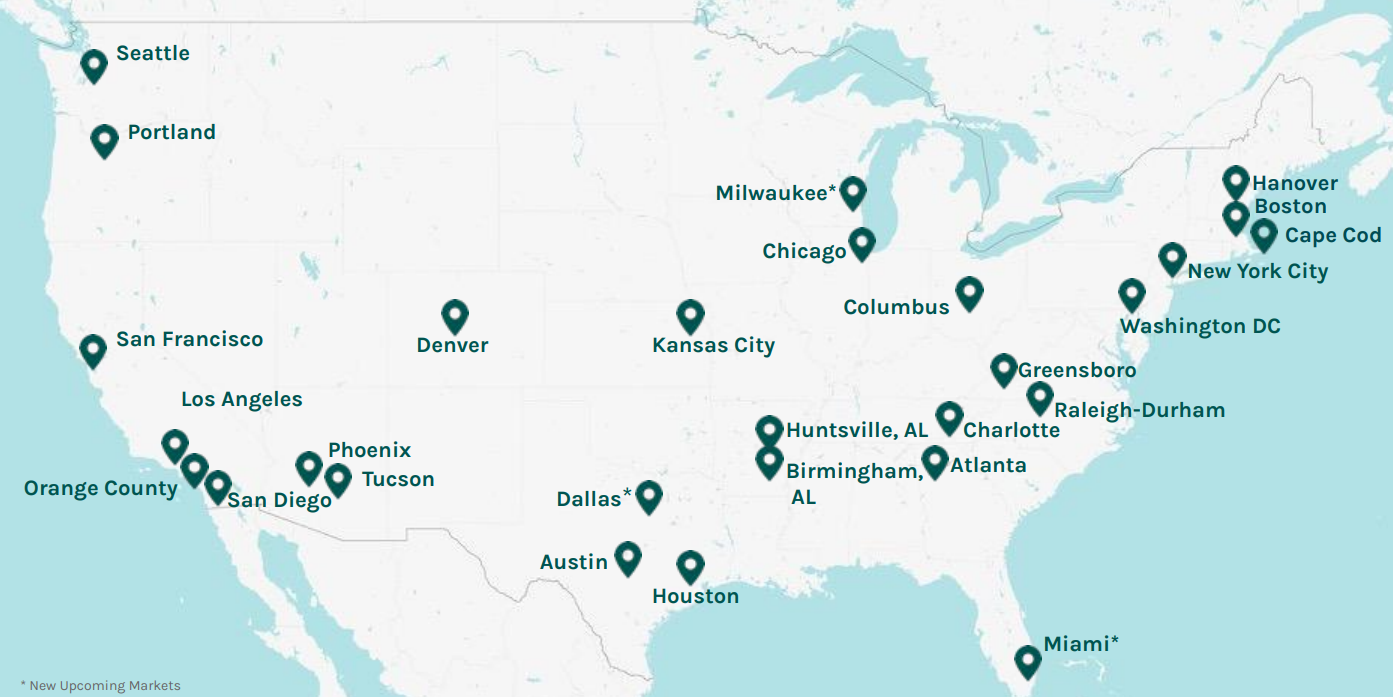

Amazon’s aspirations in the healthcare space became more transparent this week with the announcement that the company plans to acquire membership-based primary healthcare provider One Medical for $3.9 billion. According to One Medical’s 1Q22 update, the company operates 188 medical offices across 25 markets in the U.S. representing 40% of the U.S. population (below). At present, the company has 767,000 members and expects to have of 790,000-810,000 members by the end of 2022.

While it’s not exactly a secret that Amazon has been looking to expand its presence in healthcare, the acquisition will give the company a physical presence in the healthcare space for the first time. We look at the potential implications of this acquisition from a CRE perspective below:

- Why does Amazon want physical healthcare locations? We discussed Amazon’s potential inroads into physical healthcare last year, saying it was the next logical step in this category following its 2018 acquisition of PillPack, its Amazon Halo health & wellness memberships, Amazon Pharmacy, and more recently, the launch of Amazon Care. Why does Amazon need physical locations to complement its existing healthcare offerings? For starters, we believe that Amazon is interested in expanding its physical healthcare real estate portfolio for many of the reasons Walgreens, CVS, and Walmart are interested in this category--namely, it’s a large and growing market with ample recurring healthcare and subscription revenue options. One Medical’s locations could also align with Amazon’s other physical retail strategies, including easily accessible locations; hubs for pick-up, returns, and delivery staging (including prescriptions and healthcare products); a local presence for hiring and rotating employees; and a physical presence to display merchandise and explain their new brands and technologies. We also see One Medical's own technologies (digital health screenings, post-visit digital follow-ups, real-time medical record access, 24/7 healthcare accessibility) as complementary to Amazon's existing healthcare technology solutions.

- One Medical visit per location trends encouraging. When we reviewed Amazon’s decision to shutter its Amazon Books and Amazon 4-Star locations while keeping its Amazon Fresh and Amazon Go stores open, we argued that Amazon has increasingly shifted from a customer acquisition mindset – there isn’t much room to grow its Prime membership base when there are almost 170 million estimated Prime members in the U.S. – and is now focused on increasing visit frequency with its physical store strategies. One Medical fits this bill, with visits per location trending well ahead of pre-pandemic levels the past six quarters (below).

- One Medical enjoying strong post-vaccination visit trends. One Medical’s offices have had similar visitation trends as Walgreens and CVS, with last year’s vaccination period driving substantial visits on a Yo3Y basis. While not as strong as a year ago, One Medical and the drug store chains continue to see visits ahead of pandemic levels, suggesting that health & wellness remains a key priority and that consumers may be more open to this channel for primary healthcare alternatives.

- We’ve previously said that 2022 was going to be a big year for healthcare retail as CVS and Walgreens optimize their store footprint and prioritize new healthcare oriented retail formats. We believe the early success that these chains have seen with their primary healthcare locations – not to mention the healthy unit economics – played a part in Amazon’s decision to acquire One Medical. Coupled with Walmart’s aspirations in the healthcare space, this is likely a category that will see strong real estate demand (and competition) in the years to come.